Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

Every Medicare Qualification You Should Know Before You Turn 65

Table of Contents

What’s the difference between Medicare and Medicaid? How do I qualify for Medicare? What is the difference between Medicare Part A, B, C, and D? We’ll answer all those questions and more! Deciding on what you need for health coverage is difficult, but at Health Care Plan Quotes we strive to make healthcare easier to comprehend.

Plus, we want to help you find the health coverage that works for you and your budget. Call us at (855) 968-5736 every weekday from 9 a.m. to 5 p.m. and talk to one of our talented and informed agents to discover the best insurance for you.

Or you can use our Medicare quoting tool to receive an accurate estimate of what you are expected to pay.

How Do I Qualify for Medicare?

You qualify for Medicare if you’ve paid Social Security taxes for at least 10 years and turn 65. Some people might get Medicare automatically if they start getting retirement or disability benefits from Social Security before they turn 65.

You can also qualify for Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also known as Lou Gehrig’s disease).

If you have not worked in the US for at least 10 years or are ineligible for Medicare, call us at (855) 968-5736. We’ll help you find an insurance plan that suits your budget.

There are four Medicare plans available that cover different aspects of healthcare. Here’s what you need to know about each plan and their cost.

What is Original Medicare?

Original Medicare is a combination of Medicare Part A and Medicare Part B. With Original Medicare, you can go to any doctor or hospital that takes Medicare. You can also get supplemental coverage from Medigap, a former employer or union, or by purchasing Medicare Part D.

Here’s what you’re getting and how much you can expect to pay for Original Medicare:

Medicare Part A (Hospital Insurance)

Medicare Part A, known as hospital insurance, helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. If you or your spouse worked for 10 years in the United States where you paid Social Security taxes, you won’t have to pay a premium for Medicare Part A.

However, if you do not qualify for a $0 premium, you’ll pay $278 or $505 depending on how long you worked and paid Medicare taxes.

The inpatient hospital deductible for Medicare Part A in 2024 is $1,632 which policyholders must pay if admitted to the hospital.

Medicare Part B (Medical Insurance)

Medicare Part B, known as medical insurance, helps cover services from doctors and other healthcare providers, outpatient care, home healthcare, durable medical equipment (wheelchairs, walkers, hospital beds, etc), and most preventative services (screenings, shots, vaccines, and yearly “wellness” visits).

The premium for Medicare Part B is $174.70 monthly, but it might be higher depending on your income. Premium prices increase every year depending on the government’s decision. You’ll also have to pay a $240 deductible before Original Medicare once a year.

Generally, you’ll have to pay 20% of the services you receive under Medicare Part B.

Medicare Advantage (Part C)

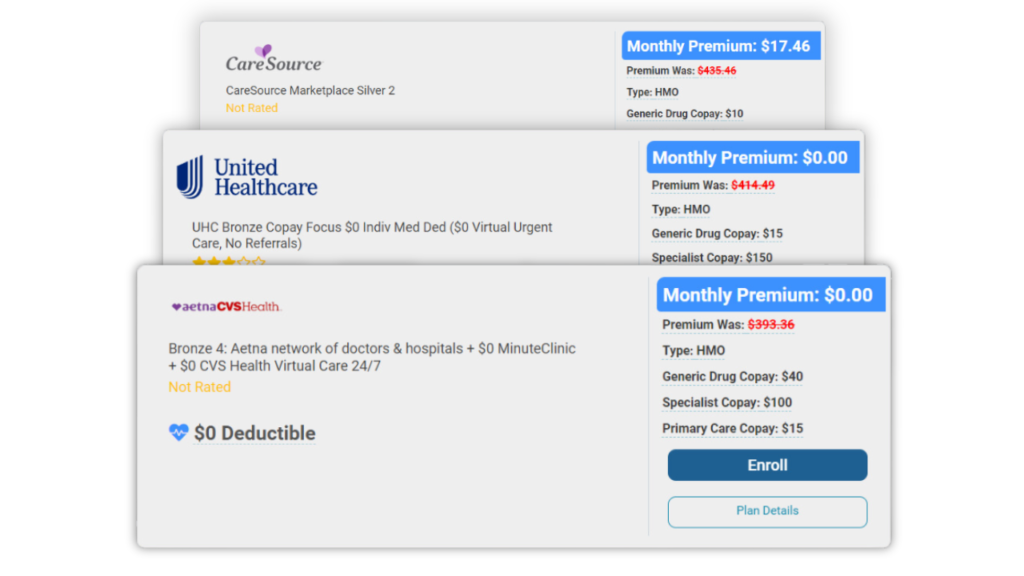

Medicare Advantage, or Medicare Part C, is a Medicare-approved plan from a private insurance company that is an alternative to Original Medicare for health and drug coverage. If you had a Marketplace plan under ACA, Medicare Advantage is the Marketplace equivalent.

These plans can include coverage equivalent to Medicare Parts A, B, and D and can be lower than paying for Original Medicare. Medicare Advantage can also cover vision, hearing, or dental services.

Each private insurance company varies, but Medicare Advantage averages around $18.50 monthly.

However, the downside is that you’ll only receive coverage when you visit a doctor in the plan’s network and are ineligible to apply for Medigap coverage.

What is Medicare Part D?

Medicare Part D, known as drug coverage, helps cover the cost of prescription drugs, recommended shots, or vaccines. Medicare Part D is optional. However, even if you don’t take any prescription drugs, you should still consider getting Medicare drug coverage.

If you opt-in outside of your Initial Enrollment Period, you will have to pay a monthly late enrollment penalty, which will only increase in price the longer you wait.

The cost of a Medicare Part D plan will vary depending on your plan and income. However, the average price is around $55.50 monthly with an average annual deductible of $545.

Medicare Enrollment Period

The Medicare Enrollment Period varies depending on your circumstances. However, there are three different periods that you should know about based on your situation.

Initial Enrollment Period

The Initial Enrollment Period starts three months before your 65th birthday, the month of your 65th birthday, and lasts until three months after your birthday: seven months.

If you sign up for Medicare before your 65th birthday, your Medicare coverage will begin at the start of your birthday month. When you sign up after your 65th birthday or during your 65th birthday month, your coverage will start the next month.

You can sign up for Medicare Part A any time after you turn 65, and the coverage can start six months before your signup date. However, it can’t begin before you turn 65.

General Enrollment Period

The General Enrollment Period for Medicare occurs every year from January 1 to March 31. Your coverage will begin the month after you sign up, and you might have to pay a monthly Late Enrollment Penalty if you don’t qualify for a Special Enrollment Period.

Special Enrollment Period

Special Enrollment Periods (SEPs) for Medicare work differently from the SEPs for Marketplace plans through the ACA. When you qualify for a SEP for Medicare, you need to submit a form to the Social Security office, and the SEP will begin as soon as the inciting incident occurs. Most SEPs will last for 6 months; however, there are some exceptions to the rule.

Here are the SEP qualifications that you should know about:

- If you lost Medicaid coverage

- If you were impacted by a natural disaster or emergency declared by a Federal, state, or local government

- Received inaccurate or misleading information from your health plan or employer

- If you were released from incarceration, you are eligible for a 12-month SEP

- Experiencing exceptional circumstances that are approved by Social Security

- If you lose your health insurance through your job or spouse’s job, your SEP will be eight months long

- Finished volunteering or serving in a foreign country

- If you have TRICARE, Social Security will notify you, and the SEP will last 12 months.

Even with a SEP, you must pay the monthly late enrollment penalty.

Late Enrollment Penalty

If you are late signing up for Medicare Part B, you must pay a monthly Late Enrollment Penalty. This late fee will be 10% extra for each year you could have signed up for Part B but didn’t, and it will automatically be added to your monthly premium.

If you are late signing up for Medicare Part D, you will pay an extra 1% each month you could have signed up for Part D but didn’t. This penalty will be added to your monthly premium as long as you have Part D.

For example, if you missed out on Medicare Part D coverage for 29 months, you’re expected to pay 29% of the beneficiary premium ($34.70 in 2024) every month you have Medicare Part D. That’s an additional $10.10 charge (as they round to the nearest $0.10).

Medigap

Medicare Supplement Insurance, or Medigap, is a supplemental insurance by private insurance companies that can help pay for out-of-pocket costs in Original Medicare. These costs usually cover copayments, coinsurance, and deductibles. Medigap is offered six months after you sign up for Medicare Part B with prices that depend on the insurance company you use.

You must have Original Medicare to purchase Medigap, and companies provide around 10 Medigap variations for different types of healthcare. Premiums will increase every year. However, discounts are available for women, non-smokers, and married couples. You can also get a discount if you pay for the entire year instead of monthly.

Medicare vs Medicaid

Medicare and Medicaid sound very similar which can confuse. However, they are very different programs in the healthcare field, and they have distinct differences. Here’s what you should know about the two programs:

- Medicare is a federal health program reserved for those 65 or older and individuals who have received disability benefits for more than 24 months.

- Medicaid is a joint federal and state program typically for low-income, pregnant, and disabled people.

It is possible to have joint Medicare and Medicaid plans simultaneously, but you will have to pay for one of the programs with no discount.

Conclusion

Medicare coverage is typically reserved for those 65 or older and can help you pay for the health coverage you might need as you age. There are a few exceptions that you should know about, but with Original Medicare, if you have been paying Social Security taxes for at least 10 years on your income, you are eligible for Medicare.

If you’re unsure about your status or want to know the exact pricing information, call us at (855) 968-5736 or use our free Medicare quoting tool to be linked to one of our talented agents. We are experts at finding the most affordable insurance to fit your situation.

Frequently Asked Questions

Medicare premiums are tax deductible if you either itemize your deductions on your tax return or if your medical expenses exceed 7.5% of your adjusted gross income (AGI).

No, Medicare and Medicaid are not the same. Medicare is reserved for those 65 or older, and Medicaid is for those who are low-income, pregnant, or disabled.

Medicare Advantage is both Medicare Part A and B offered by private insurance companies. They function as Original Medicare but with a few more benefits and at cheaper price point.

You’re eligible for Medicare if you are 65 and have paid Social Security taxes at your job in the US for at least 10 years.

You are also eligible if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also known as Lou Gehrig’s disease).

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data