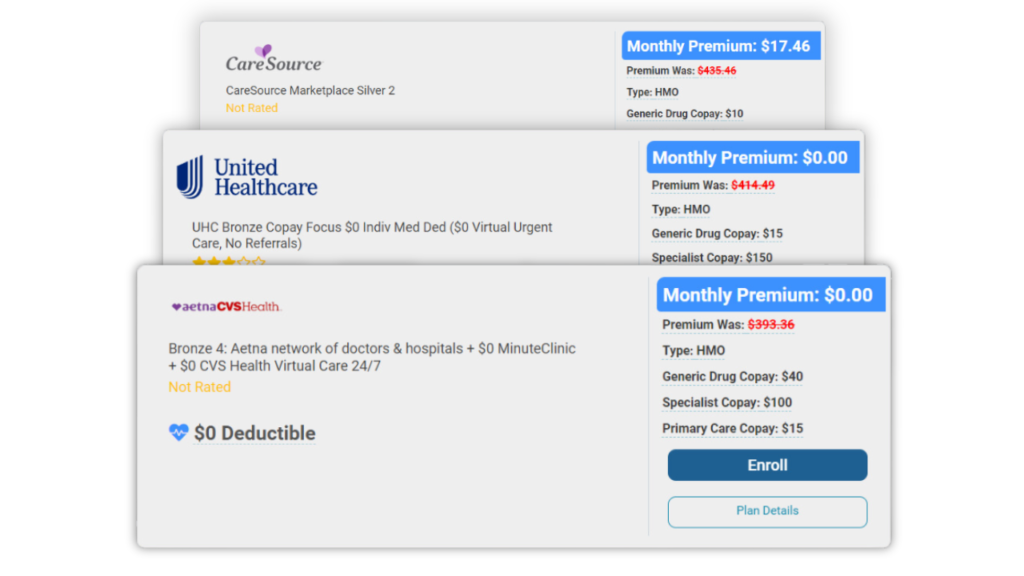

Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

Self Employed Health Insurance: Every Option You Should Know

Table of Contents

How Do I Qualify As Self-Employed?

Why Should I Get Health Insurance?

Self Employed Health Insurance

ACA Marketplace

High-Deductible Health Plans (HDHPs)

High-Deductible Health Plans (HDHPs) require policyholders to pay a high deductible before full coverage begins. According to the Bureau of Labor Statistics, the median deductible amount you can expect to pay on an HDHP is $2,500.

So why would you want to get an HDHP as a self-employed individual? The monthly premiums on an HDHP are lower than most healthcare plans, so it can appeal to those just looking for preventive coverage as it is typically covered.

Small Business Health Options Program (SHOP)

Medicaid

Short-Term Health Insurance

Self Employed Health Insurance Deduction

Is there a self employed health insurance deduction? Yes, tax benefits are available. They allow self-employed individuals to deduct health insurance premiums for themselves, spouses, or dependents. This applies to medical, dental, long-term care, and medicare premiums.

Here’s what can make you eligible for a deduction:

- You have a net profit from self-employment (as claimed on a Schedule C, Profit/Loss Business Form, Schedule C-EZ, or Schedule F)

- Had self-employment earnings claimed from a partner

- Used an optional method to figure out net earnings (as claimed on a Schedule SE, Self-Employment Tax)

- Your paid wages reported on Form W-2

You can claim a health insurance deduction even if you received partial coverage throughout the year.

How Can You Find Self Employed Health Insurance?

Conclusion

Frequently Asked Questions

Yes, health insurance premiums are deductible. You will need to claim your deductible on your yearly taxes.

Self employed health insurance costs depend on age, gender, location, health status, and income. However, four out of five Americans qualify for a $0 health plan, so your health insurance could cost you nothing.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data