Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

Everything You Need to Know About COBRA Insurance: Coverage Lengths, Costs, Eligibility & More

Table of Contents

Losing a job can be a seriously tough time. Not only will you be preparing for finding a new job and potential financial hardship, but if you were one of the 164.7 million Americans who had employer-sponsored health insurance, you may also be facing a lapse in health insurance coverage. That’s where COBRA comes in.

COBRA is a federal law that could make you eligible to maintain your previous workplace’s health plan, but you must pay for the entire cost out of pocket. COBRA and how it relates to Affordable Care Act health plans, its costs, eligibility requirements, and how long you could be covered can get pretty complicated.

Check out below for more information about COBRA or contact our expert agents at (855) 968-5736, Monday through Friday, 9 a.m. to 5 p.m., or check out our free online quoting tool

What Is COBRA Insurance?

It’s a misconception that COBRA, or the Consolidated Omnibus Budget Reconciliation Act, is a type of government-sponsored insurance. COBRA was established in 1986 to help Americans maintain their healthcare coverage while going through job transitions, primarily through continuation coverage.

COBRA continuation coverage allows eligible workers to purchase extended health care benefits offered by employers for up to 18 months. Sometimes, this can extend to 29 or 36 months after your employer-sponsored group coverage ends.

Generally, an employer-sponsored health plan is eligible for continuation coverage if the employer has over 20 employees. However, COBRA does not apply to federally sponsored health plans, or if the employer is a church or church-related organization. Many states also have “mini-COBRA” laws that make health plans offered by companies with fewer than 20 employees eligible for COBRA continuation. 44 states currently enforce these expanded eligibility requirements.

Who Is Eligible for COBRA Continuation Coverage And When Can You Apply?

- The covered employee’s death

- Voluntary or involuntary loss of eligibility for the employer’s group health plan due to either employee’s termination (with an exception for “gross misconduct”) or reduction in hours worked by the covered employee

- Covered employee becomes entitled to Medicare

- A spouse’s divorce or legal separation from the covered employee

- A dependent child reaching an age at which they are no longer eligible for coverage as a dependent of an active employee under their group plan (usually 26 years old)

However, COBRA continuation coverage does have a deadline. If you are looking to apply for additional coverage under COBRA, you must apply within 60 days of losing your previous coverage.

How Long Can You Stay on COBRA and Can It Be Extended?

- Becoming eligible for Medicare,

- Becoming disabled within the first 60 days of COBRA coverage

- A second qualifying event, like the ones listed above

The disability extension can add up to 11 months to COBRA coverage. However, premium prices could increase up to 150%.

How Much Does COBRA Cost?

Costs for COBRA can vary depending on several factors, such as your previous plan, coverage types, state of residence, and previous insurance contributions. To calculate your premium if you extend your previous plan under COBRA, add your employer’s contribution to yours, then add 2 percent for the federal service fee.

Losing the employer contribution could lead to a considerable increase in rate payments. The average employee contributes only 17% of the premium for single coverage and 29% of the premium for family coverage on an employer-sponsored group plan. Your employer pays the rest, and losing employer contributions could make your premium rate skyrocket.

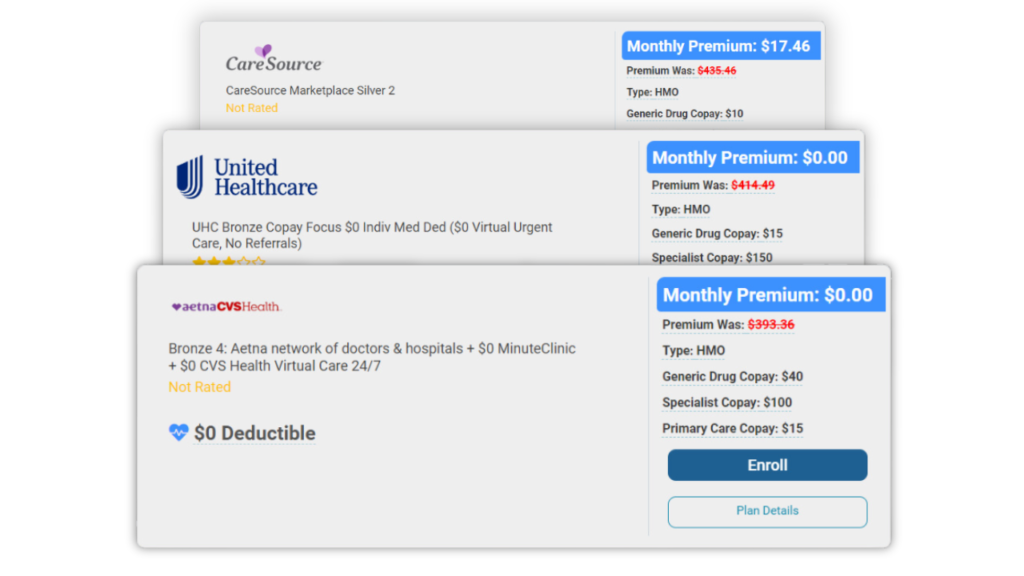

As of 2024, the average monthly cost for health insurance premiums in the U.S. is $703 for single coverage and $1,997 for family coverage. With the 2 percent fee added, COBRA continuation coverage averages about $717 for single coverage and $2,037 for family coverage.

Those entire sums are coming out of your pocket, so be ready for your premiums to rise on a COBRA plan. Thankfully, per the United States Department of Labor the Health Coverage Tax Credit (HCTC) can be used to help cover up to 72.5%of the cost of COBRA continuation coverage. Before banking on big COBRA savings courtesy of the HCTC, make sure you meet its very specific eligibility requirements, which are generally related to the effects of global trade.

If you’re eligible for the HCTC, you can considerably reduce the costs of COBRA continuation coverage, but keep in mind that it’s not reducing your monthly rate. Because it’s a federal tax credit, it’ll apply toward your yearly federal taxes. This could help you get a nice return that effectively reduces your yearly rate, but don’t look to it as a method to lower high COBRA extension monthly rates.

Does COBRA Cover Dental?

COBRA vs. Affordable Care Act: Key Differences

COBRA and the Affordable Care Act (ACA) are both federal laws designed to assist Americans access health care, but they are quite different. Many Americans may think that ACA (often called Obamacare as it was enacted during the Obama presidency in 2014) is a type of federally sponsored health insurance, but it is simply a law stipulating requirements

for health insurance countrywide.

The federal government and several states offer health care plans on marketplaces that follow ACA guidelines. The federal government doesn’t have a single mandated health plan; rather, the Federal Marketplace has a selection of ACA-compliant plans. Several states also have marketplaces that offer ACA-compliant plans.

COBRA is similarly not an insurance type. It’s a law enacted by the federal government to help maintain insurance during changes in employment but isn’t an actual insurance type.

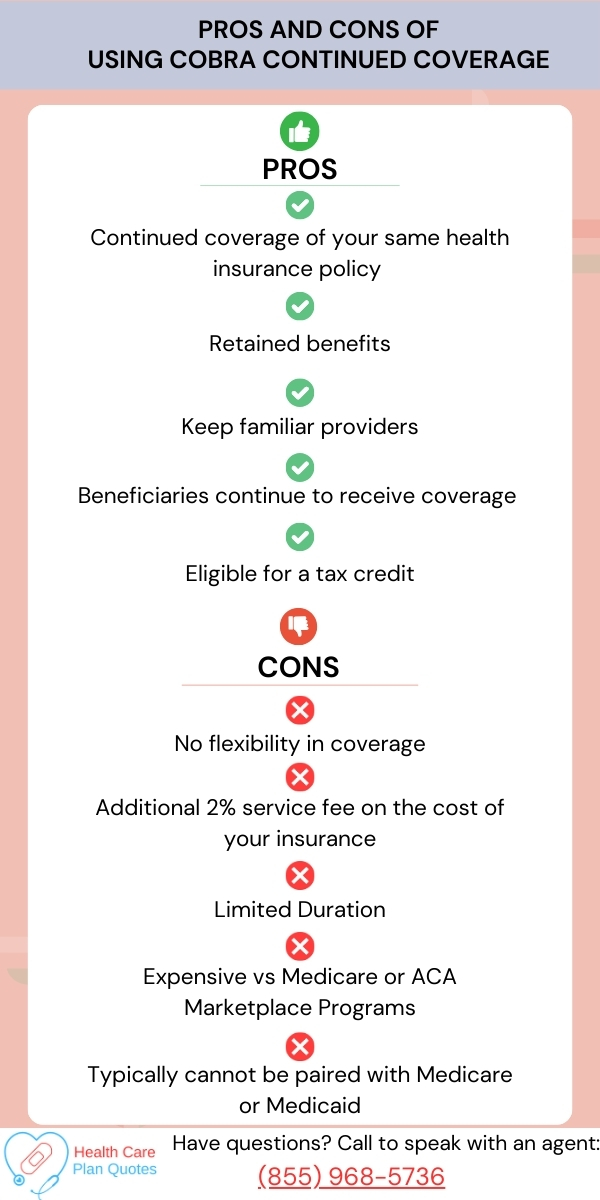

Should You Apply For COBRA?

Your individual needs, health concerns, and many other factors can affect whether selecting COBRA extended coverage is the right move for you and your family. COBRA continued coverage would likely be a good choice if you:

- Like your current employer group coverage

- Want to stay with a familiar physician

- Have a major ongoing health concern

- Don’t want your deductible or out-of-pocket maximum to be reset

- Want to avoid a penalty for a lapse in health care coverage

- Can’t find a Medicare or Federal Marketplace plan that meets your needs

You do have some time to think about choosing COBRA or a different plan; COBRA gives you 60 days to opt into continued coverage, and the Federal Marketplace also offers a 60-day special enrollment period. Use that time wisely to determine if you should keep your previous plan or find a new one. But you don’t have to do it alone; we are here to help however we can.

Conclusion

From complex eligibility requirements to high premium rates, COBRA is quite complicated. Continuing your previous health coverage with COBRA could be a great move for your family or an unnecessary expenditure during potential financial hardship.

Take out some of the guesswork if you should try to maintain your previous coverage under COBRA and contact our health care experts at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m. You can also check out our free quoting tool to learn about potential Federal Marketplace rates.

Frequently Asked Questions

Yes. Typical cases include the recipient becoming newly eligible for Medicare, a new disability, or a second event that would normally make you eligible for COBRA. These events include: a covered employee’s death, loss of group health plan, divorce or a spouse’s separation, or loss of dependent child status.

Yes; eligibility for COBRA does not affect eligibility for Medicaid or Marketplace coverage.

Yes, as long as you had dental coverage (or any other supplemental coverage including prescription and vision coverage) on your previous employer-sponsored group health plan.

COBRA continued coverage is expensive because you’re paying for the entire premium rate of your health plan without employer contributions, plus an extra service fee.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data