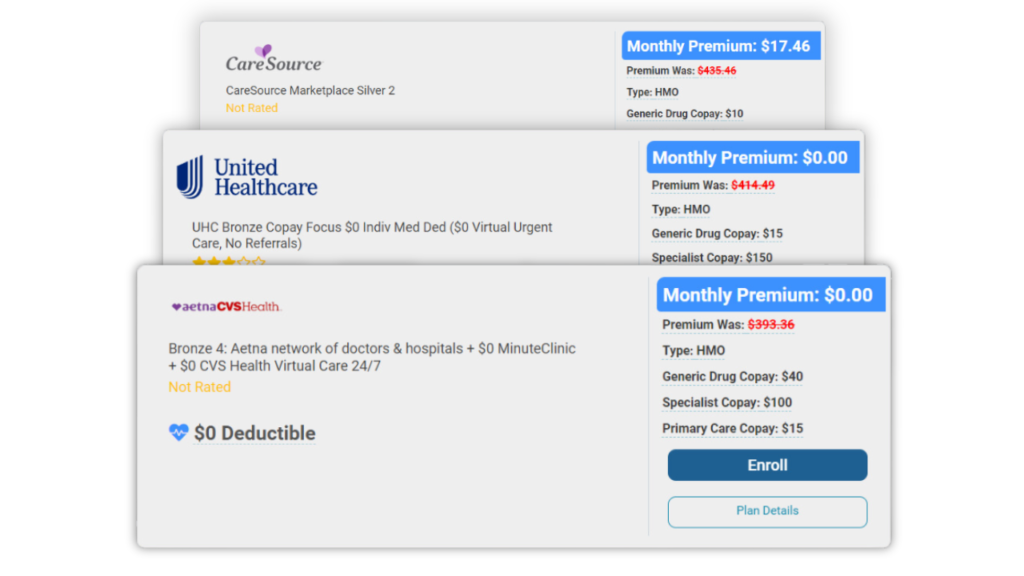

Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Last Updated: June 14, 2025

Table of Contents

Because of its low monthly costs, fixed indemnity health insurance may seem like a good way to save on your primary health insurance. However, we can explain why it shouldn’t be used as primary health coverage and only as an optional secondary insurance.

Fixed indemnity plans have major coverage limitations relative to more traditional Affordable Care Act (ACA)-compliant Marketplace plans. Using a fixed indemnity plan as primary healthcare as though it were an ACA-compliant full-coverage plan could lead to significant uncovered bills after medical services.

We recommend ACA-compliant plans on Federal and State Marketplaces as primary health insurance. A fixed indemnity plan would best be used to ease payment burdens as a supplement to a more traditional health insurance plan.

Call Health Care Plan Quotes at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m. ET, and we can help find Marketplace plans that work for your needs. Check our free online quoting tool for ACA health plan cost estimates.

What Is Fixed Indemnity Health Insurance?

Fixed indemnity health insurance is a type of healthcare that pays a set amount of money for health services on a per-period basis. Part of the misconception about fixed indemnity plans comes from them sometimes being advertised as low-cost alternatives to major medical plans. In fact, the Federal government passed an act in 2024 aimed to further distinguish fixed indemnity plans from full-coverage policies.

Unfortunately, fixed indemnity plans’ coverage and payout limitations mean they shouldn’t be used as a primary source of health coverage like a traditional plan. However, fixed indemnity may be well-utilized to supplement an existing full-coverage plan.

Fixed indemnity health insurance often has gaps in coverage, and usually does not cover the ACA essential health benefits, though coverage can vary by plan and provider.

Likewise, coverage can vary by state, as some states have additional requirements for all health insurance in addition to the Federal guidelines set by the Affordable Care Act. Check your local health insurance rules to see if fixed indemnity plans are affected by state law.

How Does Fixed Indemnity Health Insurance Cover Services?

Fixed indemnity plans pay on a per-period basis, rather than the per-service basis that major medical policies typically use. This means they pay a fixed-dollar amount based on how long a service takes, rather than the individual costs of the provided services.

For example, a traditional policy following ACA requirements may pay for a service, such as a surgery and the following 4-day hospital stay. In this example, let’s say you have a gold-tier ACA policy that covers 80% of medical service costs. Your surgery plus the 4-day hospital stay is billed at $10,000. Your ACA plan would cover $8,000 of that cost and you would be accountable for the remaining $2,000.

A fixed indemnity plan would instead cover the stay at a set hourly rate, including the time spent during the surgery. Let’s say that you have a fixed indemnity plan that pays $50 for each hour of covered services. Your surgery takes exactly 4 hours, then you have the same 4-day hospital stay, for a total of 100 hours of service. This hypothetical fixed indemnity policy would pay $5,000 for the surgery and hospital stay.

Remember these are just examples and fixed indemnity pay rates will vary. Additionally, the per-period pay rate is set at the policy’s start.

What Are The Limitations Of Fixed Indemnity Health Insurance?

Fixed indemnity plans do not meet ACA requirements for individual health insurance and are therefore not subject to ACA coverage rules. Because of this, fixed indemnity plans rarely satisfy the ACA’s individual health insurance mandate. You may be penalized if you live in a state that still enforces this mandate and uses a fixed indemnity plan as your only health coverage.

Because they don’t need to satisfy ACA individual health insurance mandates, fixed indemnity plans are not required to cover the ACA essential health benefits or provide other required services. They may have gaps in coverage, may not cover preexisting conditions, and aren’t required to guarantee acceptance.

If you are relying on a fixed indemnity policy as your primary insurance, you may see major bills for medical services you thought would be covered. Many fixed indemnity policies have a high out-of-pocket maximum and low annual payout maximums. And the restrictive payout structure may mean medical services won’t be entirely covered.

Fixed indemnity plans don’t have copayments or coinsurance costs; the major costs are your monthly premiums and service charges. It may be a point in fixed indemnity’s favor that it doesn’t involve copayments or related charges, as you will always know what costs are covered due to its inflexible payout structure.

But despite its drawbacks, fixed indemnity plans still cover a range of services and can be used as a secondary source of healthcare coverage.

What Does Fixed Indemnity Health Insurance Cover?

Fixed indemnity plans can cover a wide range of supplemental health services. Commonly covered services include, but are not limited to:

- Hospital stays for a set number of days

- Outpatient diagnostic and imaging services (such as MRI, lab testing, and X-Rays)

- Intensive Care Unit stays

- Anesthesia

- Surgeries

- Emergency room visits

- Emergency transport by ambulance

- Outpatient radiology or chemotherapy

- Limited preventive care procedures (such as colonoscopies or mammograms)

Who Should Use Fixed Indemnity Health Insurance?

Fixed indemnity health insurance is best used to supplement existing primary coverage, from employer-sponsored plans or Marketplace policies. Anyone stuck with a high deductible, copayment, or coinsurance struggling to cover their high costs could make good use of fixed indemnity plans.

This is partially because fixed indemnity plans pay directly to the policyholder rather than the health service provider. A fixed indemnity policy could use the payment to help policyholders with their health bills directly.

Fixed indemnity is also customizable in its enrollment policies. Like short-term health insurance or other private, optional plans, you can enroll or cancel a fixed indemnity plan whenever you want. You’re not restricted to the open enrollment period you must use to enroll in a Marketplace plan.

If you are looking at fixed indemnity insurance as a low-cost primary health insurance plan, contact Health Care Plan Quotes. We suggest looking to the Marketplace instead. While fixed indemnity plans can be inexpensive options, cost-reducing subsidies and tax credits can reduce premiums for ACA-compliant policies to $0 monthly.

Conclusion

Fixed indemnity health insurance is not suitable as primary insurance, but can serve as helpful supplemental insurance at an inexpensive monthly rate. For a personalized healthcare plan, consider combining fixed indemnity insurance with a robust Marketplace policy. This is one way to use fixed indemnity to secure thorough coverage that pays out in multiple ways.

Contact Health Care Plan Quotes for help developing your healthcare strategy. Call us at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m. ET to review available policies and eligibility. Check our free online quoting tool for cost estimates on ACA-compliant health insurance plans to use as the basis of your healthcare coverage.

Frequently Asked Questions

No; fixed indemnity plans do not count as health insurance meeting the ACA individual health coverage mandate and are therefore not subject to ACA coverage requirements like the essential health benefits.

You can enroll at any time and are not required to apply during an open enrollment period. Likewise, you can cancel a policy anytime.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data