Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

Coinsurance vs Copay — Every Difference Explained

Table of Contents

So your insurance requires a $20 copay with a 20% coinsurance. But what does that mean exactly? Is there a difference between coinsurance vs copay? Are they the same? We’ve discovered everything you need to know to help you choose the cheapest health insurance for you and your family.

If you’re looking for more affordable health insurance, Health Care Plan Quotes agents are experts at navigating the ACA Marketplace. Call us at (855) 968-5736 or use our quoting tool for free to see the coverage options available.

Here’s how you can determine the difference between coinsurance and copayments:

What is Coinsurance?

What Does Coinsurance Look Like in the ACA Marketplace?

- Bronze Plans cover 60% of your health expenses

- Silver Plans cover 70% of your health expenses

- Gold Plans cover 80% of your health expenses

- Platinum Plans cover 90% of your health expenses

What is Copay?

Copayments are fixed payments for healthcare services such as office visits and prescription drugs. For example, if your copay is $20 on a doctor’s visit, you must pay $20 after services have been rendered and your health insurance will cover the remaining amount. Typically, you will start paying your copay once you meet your deductible. However, there are health insurance plans that allow you to pay your copay before meeting your deductible amount.

Your copayment can differ depending on the type of care you receive, the prescription you pick, or if you choose an out-of-network provider. Plus, HMO plans typically have higher copayments compared to PPO plans.

According to the Kaiser Family Foundation (KFF), an average copayment is $26 and $44 for specialty visits.

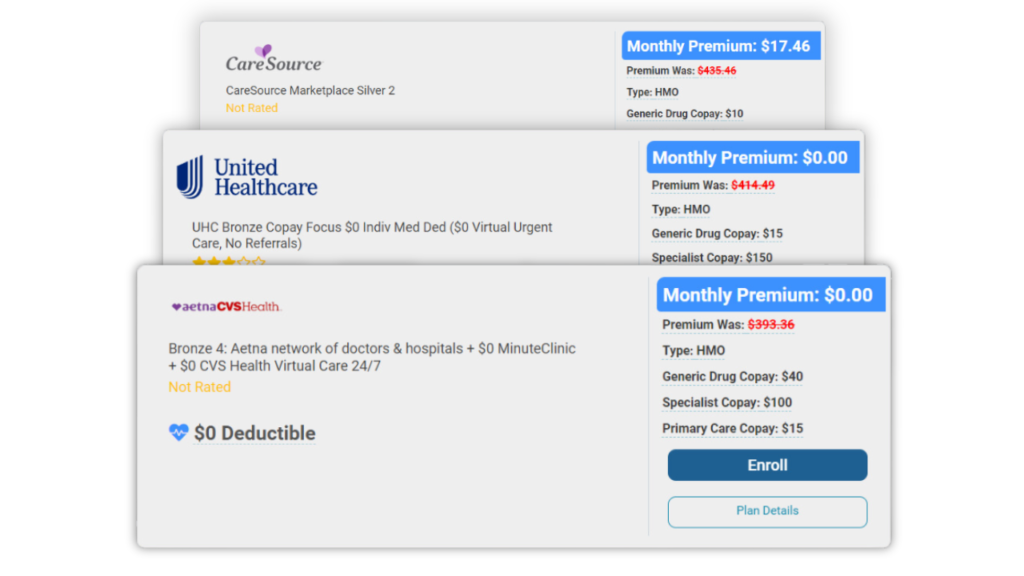

What Do Copayments Look Like in the ACA Marketplace?

Copayments under the ACA Marketplace will depend on the plan that you choose. However preventive care is fully covered with ACA-compliant plans, so you will not pay copayments on those visits.

Coinsurance, Copays, and Deductibles

Deductibles are the healthcare services you must pay for before your copays and coinsurance kick in to help with health coverage. The average deductible cost through a Federal Marketplace plan is $5,452, which means you’ll need to spend $5,452 before you can get the full benefits of your health insurance.

Some plans on the ACA Marketplace will have separate deductible amounts for prescription drugs and preventive benefits are fully covered and exempt from payment.

Coinsurance vs Copay

Coinsurance vs Copay Similarities

- Used to pay for healthcare coverage

Both copays and coinsurances are used to cover healthcare costs. Your health insurance provider covers the remaining costs once you pay for your service and the claim is approved.

- You can use your HSA money to cover both copays and coinsurance

If you have an HSA plan through your workplace or a high-deductible health plan, you can use those funds to pay for copays and coinsurance. - Once you hit your out-of-pocket maximums, you won’t have to pay for coinsurance or copays (depending on your plan)

An out-of-pocket maximum is the maximum amount of money you can pay toward healthcare services before your health insurance provider covers all costs. Every payment you make on copays and coinsurance will go towards fulfilling your out-of-pocket expenses.

Coinsurance vs Copay Differences

- Coinsurance works off percentages and copay is a fixed amount

Calculating coinsurance payments is based on percentages, so you must calculate how much you pay for your service. Copays are always a fixed amount indicated after you sign up for your health insurance plan.

- Copays are used for certain office visits, prescription drugs, and therapy. Coinsurance is used for medical services.

This is a bit trickier to explain since each insurance classifies when to use coinsurance and copayments differently. Generally, coinsurance is only used to pay for pricier procedures of specialized treatment while copays cover general services like office visits and prescription drugs.

- Coinsurance only applies once you’ve hit your deductible; copays can apply before and after you’ve fulfilled your deductible amount.

Before you hit your deductible amount, you are responsible for all the medical coverage you might incur. However, once your deductible is fulfilled, coinsurance will kick in to cover the remaining balance. Copays apply before and after deductible fulfillment. However, that depends on your plan.

Coinsurance and Copayment Example

Consider that you have fulfilled your deductible on your healthcare plan, and your copay amount is $20 with a $40 specialty charge with an 80/20 coinsurance ratio. Here is a scenario that you could encounter:

- You go to your primary care physician, and they suggest that you go to a specialist: a $20 charge

- Your primary care physician suggests that you see a specialist for a specific issue you encounter: a $40 charge

- Your specialist recommends surgery that costs $2,000 in total. You get the procedure done and pay the coinsurance amount: a $400 charge

- Your total charge for services done is $460

This is a hypothetical scenario, and all numbers and situations have been fabricated. For accurate plan information, call one of our talented agents at (855) 968-5736 or use our free quoting tool to get specific coinsurance and copayment prices.

Conclusion

Frequently Asked Questions

A 20% coinsurance means you will pay for 20% of the healthcare service billed and your insurance provider will cover the rest.

No, deductibles and copays are not the same. Deductibles are the amount that you need to pay before copays kick in.

Yes, if you have a health insurance plan that includes coinsurance and copays, you must pay coinsurance and copayments as indicated in your plan.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data