Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

Here’s Everything You Should Know About Deductibles

Table of Contents

So, you just got your new health insurance plan and received a deductible. But what does that mean, exactly? We’ll show you exactly what is a deductible and how it affects your coverage. The average cost of a deductible, when your coinsurance or copay kicks in, and an out-of-pocket explanation will be explained.

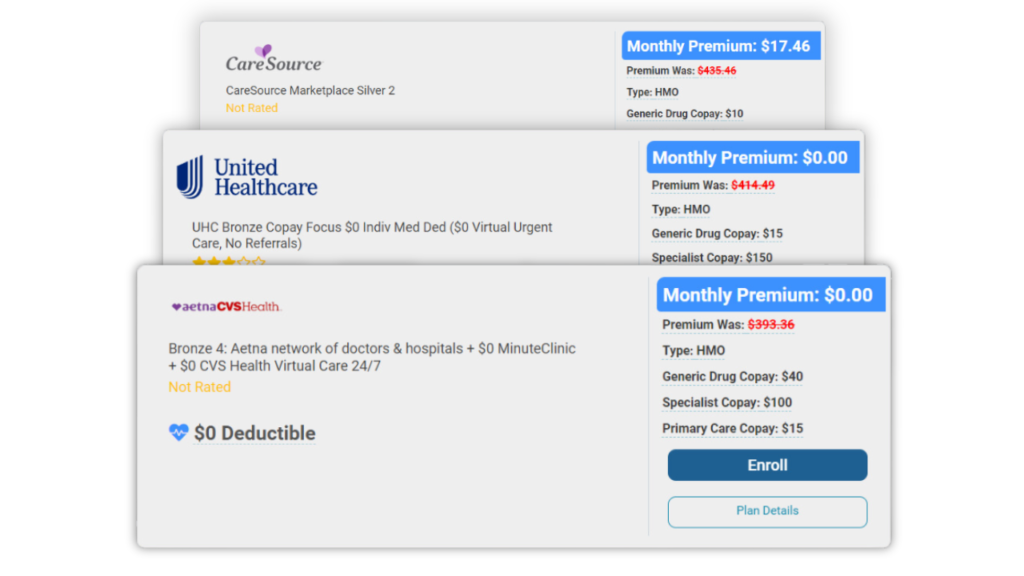

If you’re looking for the cheapest deductible (or health insurance) with the highest coverage, call us at (855) 968-5736. Our agents are experts at navigating the ACA Marketplace and are happy to assist you in finding the right plan. If you aren’t ready to talk to an agent, check out our unique healthcare search tool for free. It’ll give you the most accurate estimate of what coverage you can get with a Marketplace

What is a Deductible?

A deductible is the money you will pay before your coinsurance and copay coverage begins. Typically, you must pay off your entire deductible for any coverage to start on your health insurance.

For example, if you have a $1,000 deductible on your health plan and go to the doctor for a $450 service, you are responsible for the entire visit. Your deductible has now been reduced to $650 which you still have to pay.

Deductibles in the ACA Marketplace

What is an Out-of-Pocket Maximum?

An out-of-pocket maximum is the most you can pay for in-network coverage for a year. When you hit your out-of-pocket maximum, your health insurance provider will cover your medical costs for the remainder of the year.

Your deductible, coinsurance, and copay payments all contribute to your out-of-pocket maximum, so if you are making payments for medication and doctor visits, you will be contributing to your out-of-pocket maximums.

Out-of-Pocket Maximums in the ACA Marketplace

All plans on the ACA Marketplace have an out-of-pocket maximum cap of $9,540 for individual coverage and $18,900 for family coverage.

Aren’t sure where to start or if you qualify for a health insurance plan through the Federal Marketplace? Call one of our experienced agents at (855) 968-5736, and we will help guide you through the Marketplace to find the coverage you need.

Coinsurance vs Copay vs Deductible

Coinsurance, copays, and deductibles are all payments you must make to your healthcare provider to receive full coverage on your health plan. But what makes them different from each other? Here’s what you should know about each healthcare term:

Coinsurance

Coinsurance is a percentage of healthcare services you must pay for based on coverage. If you have a 20% coinsurance, you are responsible for 20% of the services provided, and the healthcare provider will cover the remaining 80%.

For example, if you went in for a $1,000 medical procedure, and they asked you to pay the coinsurance, you’ll pay $200 and your health insurance provider will pay $800.

Copayments

Copays are a fixed amount you pay for your covered healthcare service. Normally, you will receive two copay amounts: a general and a specialized copayment. Your health insurance will provide the remaining amount due after you pay the specified copay.

Let’s say your copay is $20 for a general doctor’s visit. Every time you visit that provider, you are required to pay $20 until you meet your out-of-pocket maximum, and your insurance company will pay the remaining charge.

How Does a Deductible Affect Coinsurance & Copays

You start coverage with coinsurance and copayment amounts when you meet your yearly deductible. Some plans let you bypass the deductible and start with your copay. Unfortunately, if you have coinsurance, there are no health plans that allow you to bypass the deductible payment and just pay the coinsurance amount.

Generally, you must pay your deductible to get a discount on health services with coinsurance and copays.

Conclusion

Frequently Asked Questions

When your deductible is met, you’ll start paying your copay or coinsurance amount instead of paying for medical services.

Deductibles are the payments that you need to make to have access to your health insurance discounts through copays and coinsurance.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data