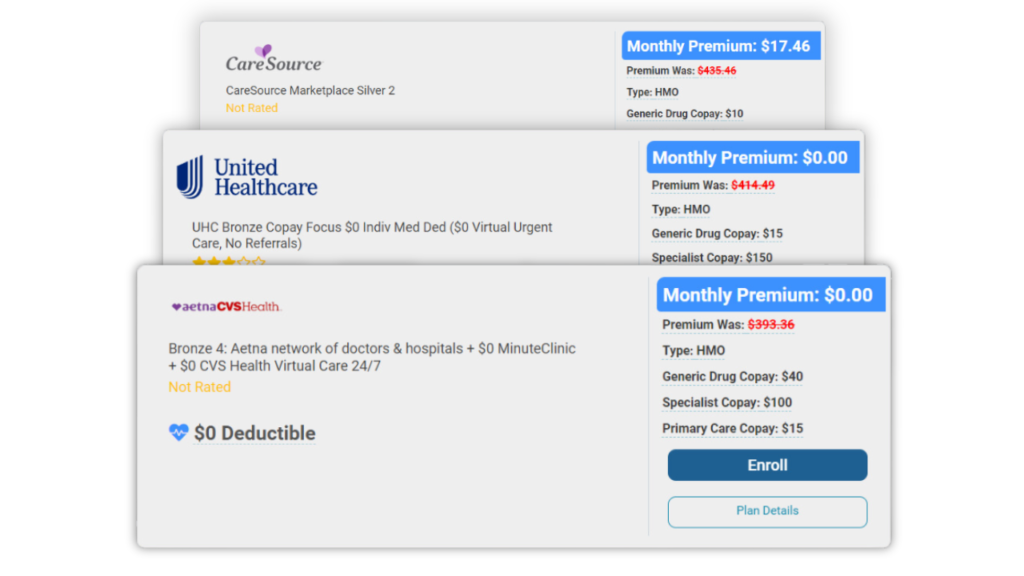

Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

How to Make Dental Insurance Work For You — Marketplace Plans & More

Table of Contents

Depending on where you go, dental cleaning could cost you an average of $203 according to CareCredit. And that isn’t including costs that might come up like fillings, braces, gum disease treatment, and more. But how can I grab dental insurance? Does my health insurance come with dental coverage? How do I know exactly what my dental insurance would cover?

We’ve got all the answers that you should know about and more. If you’re wondering what the best dental insurance is for you and your family, call us at (855) 968-5736. One of our informed agents is ready to help you find the right coverage. We also have a free quoting tool that can help you find an accurate estimate on insurance for you and your family.

What is Dental Insurance?

Much like health insurance, dental insurance requires you to pay a monthly premium for cheaper dental coverage in the future. According to Forbes, the average monthly premium for dental insurance typically costs $52. Dental insurance was made to decrease the financial burden that dental procedures and check-ups can bring.

What Does Dental Insurance Cover?

Your monthly premium will help cover the cost of these treatments:

- Preventive Care: routine cleanings, fluoride treatments, dental sealants, oral evaluations, etc

- Basic Restorative Care: root canals and fillings

- Advanced Restorative Procedures: crowns, dental bridges, dentures, etc

Typically, dental insurance will cover 100% of preventive care, 80% of basic restorative care, and 50% of advanced restorative procedures. However, each plan is different, so read your plan carefully to discover how much your insurance will cover.

Can I Get Dental Insurance Through the ACA Marketplace?

Is dental insurance available through the ACA Marketplace? Yes, you can grab dental coverage through the Marketplace. However, you will only be able to grab plans during the general enrollment period (unless you are eligible for a special enrollment period) and plans are not automatically included in your health coverage unless you are 18 or younger.

Typically, you will pay an additional fee on top of your health coverage premiums if you want dental insurance and only a few plans include dental coverage. Call us at (855) 968-5736, and we will help you navigate the ACA Marketplace and find the best dental plan for you.

Dental Insurance and Medicare

You might not have dental coverage if you are 65 or older and have Medicare. Original Medicare (which includes Part A and B) does not include dental insurance, so if you need dental coverage, you should look into Medicare Advantage (Part C) plans.

Medicare Advantage plans not only include Original Medicare, but they can also include dental, vision, and hearing coverage. Medicare Advantage plans are cheaper than dental insurance, averaging around $18.50 monthly. However, not every Medicare Advantage plan has dental benefits, so review your plan carefully to know what you have.

Types of Dental Insurance

Overall, there are three types of dental insurance that you can grab for you and your family. Each of them has its advantages and disadvantages, so make sure you review each policy to determine exactly what you need. If you need assistance finding dental insurance, call us at (855) 968-5736, and our talented agents will help you maneuver the Marketplace for their dental plans.

Here are the different types of plans that you can use:

Dental Health Maintenance Organization (DHMO)

A dental health maintenance organization (DHMO) is a network of dentists or dental offices you can choose from in a specific area that gives you discounts if you buy their plan. You will select a primary care dentist who will refer you to a specialist in the network if you need specific care.

With a DHMO, you won’t have any annual maximum or deductibles and copayments will be cheaper or non-existent. But if you step out of the network, you must pay the full amount as your insurance won’t cover costs outside the DHMO.

Dental Preferred Provider Organizations (DPPO)

Dental preferred provider organizations (DPPO) offer more flexibility from your plan. With a DPPO, you have a larger network of dentists to visit and more services covered. You’ll also be able to go to a specialist without having a referral from your primary care dentist.

Generally, because you are given so much flexibility with a DPPO plan, you will pay higher deductibles, premiums, and out-of-pocket costs for your dental procedures. You’ll have to weigh your options to see which works best for you.

Dental Discount Plans

Dental discount plans are not classified as insurance. However, insurance companies can offer these in place of dental coverage. Once you enroll in a discount plan, you’ll receive a card that you can show to a participating dental office, and they will give you a discount on the procedure you’re receiving.

Each dental discount plan is different, and the price of procedures and general care will depend on the plan distributed. Make sure you know what your plan will cover and the discounts that are associated with the plan before you start your discount plan.

ACA Pediatric Dental Insurance

If you have a child under 18, the ACA makes dental coverage an essential benefit for your child. These plans are available on the Marketplace. However, while the ACA does require pediatric dental insurance to be on the Marketplace, you do not have to purchase the plans.

We’ve got everything you need to know about the ACA Marketplace, including prices and ACA essential health benefits that every plan has.

Conclusion

Dental insurance is an added benefit that you can include in your health insurance coverage, but it typically will not be initially included in your health coverage plans. While you might not think you need dental insurance, it can be an investment in your health and help with any unexpected costs you could incur.

At Health Care Plan Quotes, we can determine if you should pick up dental insurance. Call us at (855) 968-5736, and you’ll be connected to one of our committed agents who will help find a perfect policy for you.

Looking for more health insurance coverage? Check out our unique quoting tool that will show you what plans are available to you on the Marketplace.

Frequently Asked Questions

This will depend on the plan you have. While implants can be medically necessary, some plans think of implants as cosmetic, so they will deny your claim depending on the necessity of the implants.

Review your plan to determine what it will cover and what circumstances it will provide coverage.

If your dental insurance premiums are being used to prevent or alleviate disease, it is eligible to be deducted according to the IRS.

It does depend on your insurance plan and circumstances. Plans typically cover traditional metal braces, but finding coverage for different braces might be harder to find.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data