Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

What Are The Differences Between Health Insurance Types?

Table of Contents

Signed into law in 2014, the Affordable Care Act (ACA) instituted several guidelines intended to simplify healthcare. The most major change was standardizing public and private health insurance types with a categorized tiering system.

The ACA specified 4 standard health insurance tiers: bronze, silver, gold, and platinum. Insurance-covered costs and premium rates vary between each of these health insurance types.

Each category’s costs can get pretty complicated when factoring in potential subsidies or each state’s coverage differences. Learn more below or contact Health Care Plan Quotes to find what level plan you may need. Call us at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m. ET, or search for a plan that can fit your circumstances with our free online quoting tool.

What Are The 4 Health Insurance Types?

The Affordable Care Act stipulates that all health insurance plans are placed into four categories with their names simplified as “metal levels”. In order of lowest cost coverage to highest, the ACA health insurance categories are bronze, silver, gold, and platinum. A fifth category – catastrophic – also exists but has unique eligibility requirements.

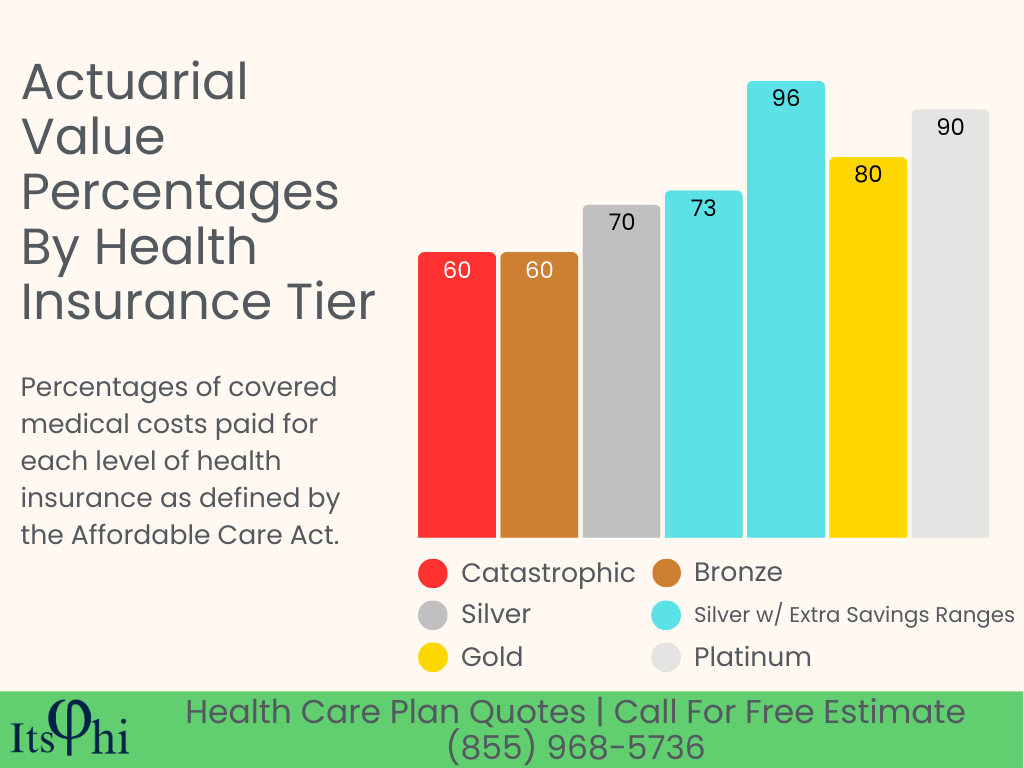

Covered service costs are calculated based on actuarial value. Each plan type has a different percentage of the actuarial value of health services covered by insurance.

Actuarial Value: How Health Insurance Tiers Are Calculated

Actuarial value is the percentage of costs for covered medical services that your health insurance plan pays. Each health insurance type will have a different covered actuarial value percentage. Actuarial values will generally be higher on more expensive, higher-tier plans.

For example, let’s say you have a plan that covers a 60% actuarial value on medical services. You go to your physician’s office and are charged $200 for the provided service. Your plan will cover 60% of that service, or $120. You’d need to pay for the remaining 40%, or $80.

Bronze Health Insurance

Bronze is the lowest-tier health insurance type. Bronze plans will have the lowest monthly premium costs and the smallest percentage of health costs covered by insurance. Additionally, deductibles on bronze plans will generally be the highest out of the standard plan types.

Bronze plans cover a 60% actuarial value. These plans are a good choice for those in good health who aren’t expecting many doctor or hospital visits or want to save money on premiums but still want emergency coverage.

Silver Health Insurance

Silver is the next level of coverage. Silver-tier plans usually have the second-lowest monthly premium costs and the second-lowest actuarial value coverage. However, silver plans are also affected by subsidies that could lead to them having even lower premiums than bronze plans and better actuarial coverage than some higher-tier plans.

Typically, silver plans pay for 70% of covered medical costs. If the policyholder qualifies for subsidies and tax credits, the actuarial value could be up to 96% of covered services. Silver is usually the best choice for those on a budget because of these credits, subsidies, and the actuarial coverage-to-premium ratio.

Gold Health Insurance

Gold is the second-highest level of coverage. These plans will usually have higher monthly premiums than silver plans, but cost-sharing initiatives or laws in some states may make gold-tier plans cost less than silver plans.

Gold plans provide an 80% actuarial value and are a good choice for those who want that extra coverage and expect to visit doctors, hospitals, or specialists somewhat frequently.

Platinum Health Insurance

A platinum plan is the health insurance type with the highest level of coverage. Platinum plans have the highest monthly premiums but cover the highest actuarial value. They have the lowest deductible costs and out-of-pocket maximums from all healthcare tiers.

These plans will pay for an actuarial value of up to 90% of covered services. Platinum healthcare plans are the best choice for those who aren’t in great health or expect frequent visits to healthcare providers.

Catastrophic Health Insurance

Catastrophic health plans are roughly equivalent to bronze plans, covering an identical 60% of actuarial value. Catastrophic plans tend to have lower premium rates than bronze-tier plans, but higher deductible amounts.

Catastrophic plans are generally affordable protection from worst-case scenarios, such as major illness or injury. They also have specific eligibility restrictions; only people under 30 or those with a hardship or affordability exemption qualify.

You can qualify for hardship exemptions if you experienced financial hardship or other circumstances that prevented you from getting health insurance, including:

- Homelessness

- Eviction or foreclosure

- Bankruptcy

- Substantial damage from a natural disaster

- Medicaid eligibility denial

- And more hardships

What Does Each Health Insurance Type Cover?

- Outpatient medical care & preventive care

- Emergency services

- Hospital services

- Pregnancy and maternity care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services

- Laboratory work

- Preventive and wellness services

- Pediatric services, including oral and vision care (adult dental and vision coverage are not covered as essential services)

Do Premiums Cost More For Higher Health Insurance Tiers?

Logically, higher-tier health insurance types will generally cost more than lower-tier ones. So you can typically expect to pay higher monthly premiums for a platinum plan than a bronze plan.

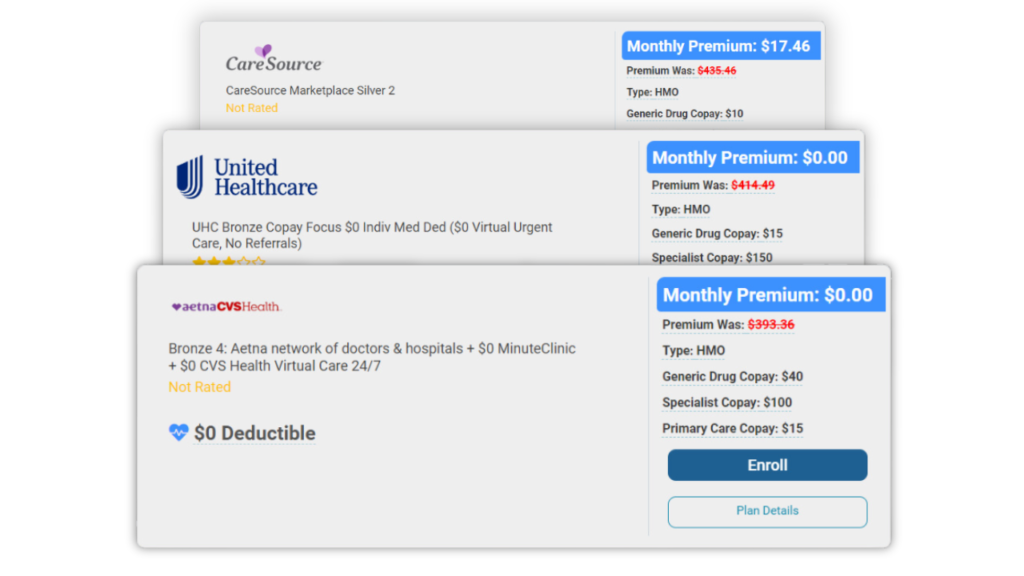

This was how it normally functioned for several years after the ACA was implemented, but federal tax credits, state subsidies, and more have significantly affected prices.

Eligibility for cost-sharing reductions, subsidies, credits, and other premium reductions can get complicated, so it’s important to get advice from someone you trust. As experts on health insurance, Health Care Plan Quotes can help you maximize your savings on a marketplace plan.

How Do Cost-Sharing Reductions Work?

Cost-sharing reductions, tax credits, and other subsidies significantly affected marketplace insurance pricing. Those eligible for cost-sharing subsidies must select a silver-category plan for savings.

Eligibility for cost-sharing subsidies varies depending on the state, as many states run marketplaces with requirements that differ from federal ones. Overall, eligibility is based on yearly gross income, number of dependents, and where you live.

If you qualify for cost-sharing reductions, you can expect a lower deductible, lower copayments, and a lower out-of-pocket maximum on a silver marketplace plan. Actuarial values for a silver plan with extra savings from a cost-sharing reduction range from 73% to 96%. The percentage varies based on your income, dependents, and other factors.

Conclusion

The four primary Marketplace health insurance types – bronze, silver, gold, and platinum – all cover different percentages of your health costs. To get a higher percentage covered by insurance, you’ll generally need to pay a higher premium rate, but several subsidies and credits can affect your price for a marketplace plan.

Figuring out which subsidies or credits you could be eligible for can get complicated. That’s why contacting a trusted health insurance brokerage like Health Care Plan Quotes can help you. Call us at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m. ET, or check our free online quoting tool for marketplace premium estimates.

Frequently Asked Questions

Out-of-pocket limits, which are the maximum amounts you are required to spend annually on copays and associated medical service costs, apply to each of the four marketplace health insurance tiers. Higher insurance levels like platinum plans will generally have a lower out-of-pocket limit.

In order of lowest percentage of medical costs covered to highest, the four health insurance types are bronze plans, silver plans, gold plans, and platinum plans.

No. Medical services covered by each tier will be the same, as they each follow ACA guidelines for essential medical services, but the percentage of medical costs covered varies by tier.

Actuarial value is calculated from the average cost of medical services covered by marketplace plans. Each plan category covers a different percentage of the actuarial value, with platinum plans covering the highest percentage.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data