Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

Health Insurance While Unemployed: Here's What You Should Do To Keep Coverage

Table of Contents

Losing a job is a difficult time. In addition to preparing to find a new job or potential financial hardship, you may be facing the loss of your health insurance coverage. Thankfully, you have several affordable options for health insurance while unemployed.

Your options for health insurance while unemployed can be complex. From Marketplace plans to Medicaid and more, it can get pretty overwhelming.

That’s where Health Care Plan Quotes can help. Our expert agents thoroughly understand the health insurance market and want to help you find the health insurance plan that best fits your needs. Call us at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m. ET. Be sure to use our free online quoting tool for healthcare estimates.

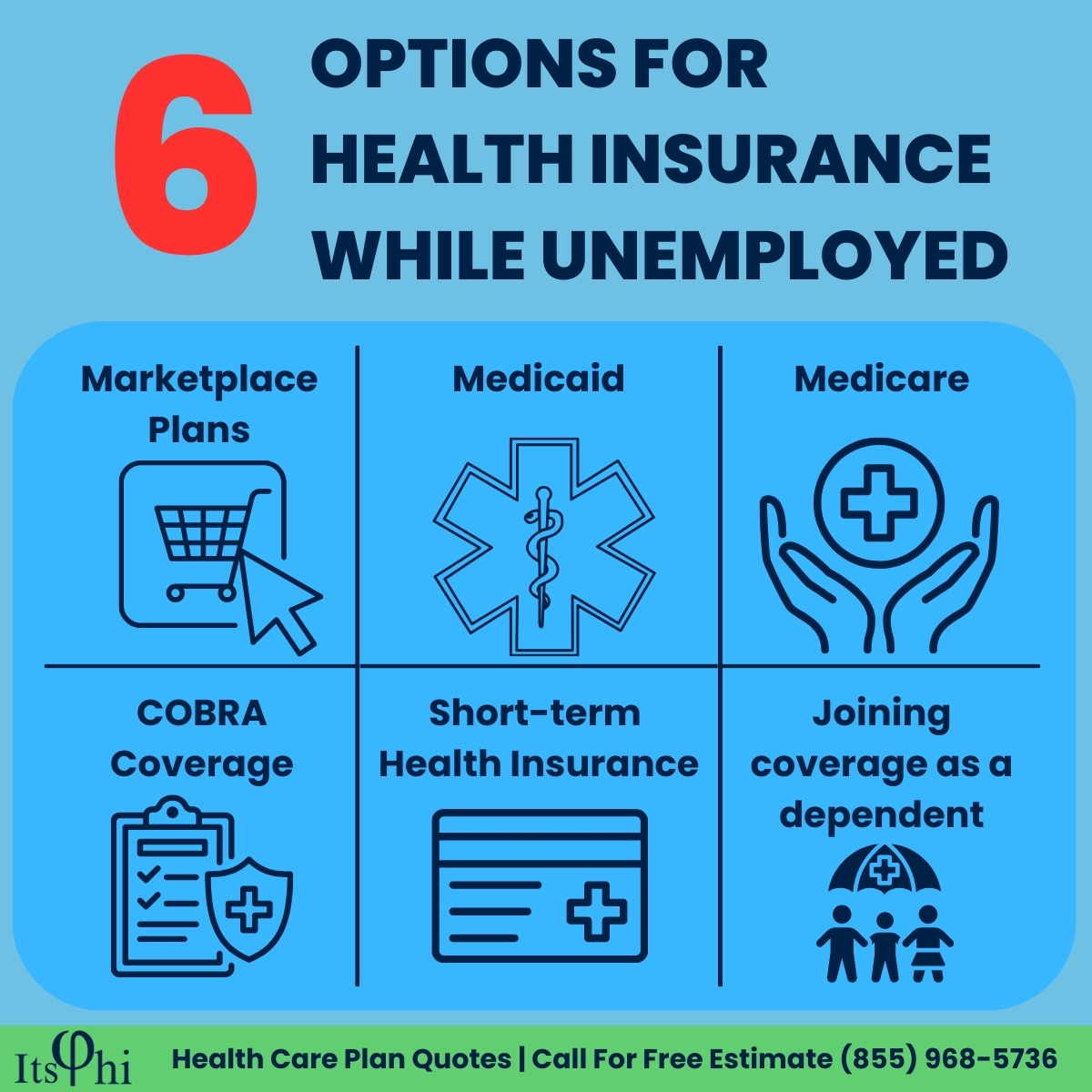

What Are Your Options For Health Insurance While Unemployed?

- Federal and State Marketplace plans

- Medicaid

- Medicare

- COBRA Continuation Coverage

- Short-term health insurance

- A spouse or parent’s existing coverage with dependent coverage

Marketplace Health Insurance While Unemployed

The Federal Marketplace is the first place to look for affordable health insurance while unemployed. Many states have a Marketplace; if you live in one, ensure you’re looking at the correct Marketplace.

According to the Affordable Care Act (ACA), federal and state Marketplace plans are required to provide coverage levels in a tier system. They also have ten health benefits listed as “essential health benefits” – health services that are mandatory coverage for all ACA-compliant Marketplace plans, such as preventative care at your doctor’s office.

As with most health insurance plans, you can normally enroll in a Marketplace plan during a specific time: the open enrollment period, which runs yearly from the beginning of November to mid-December. If you lose your job mid-year, you don’t need to wait for the open enrollment period to join a Marketplace health insurance plan.

You’ll be eligible for a special enrollment period for Marketplace plans for 60 days after losing your employer’s health insurance. This will give you time to research your options for health insurance while unemployed.

Contact Health Care Plan Quotes for help with your search. As a licensed health insurance brokerage, we can help you find the plan that best fits your health and financial needs.

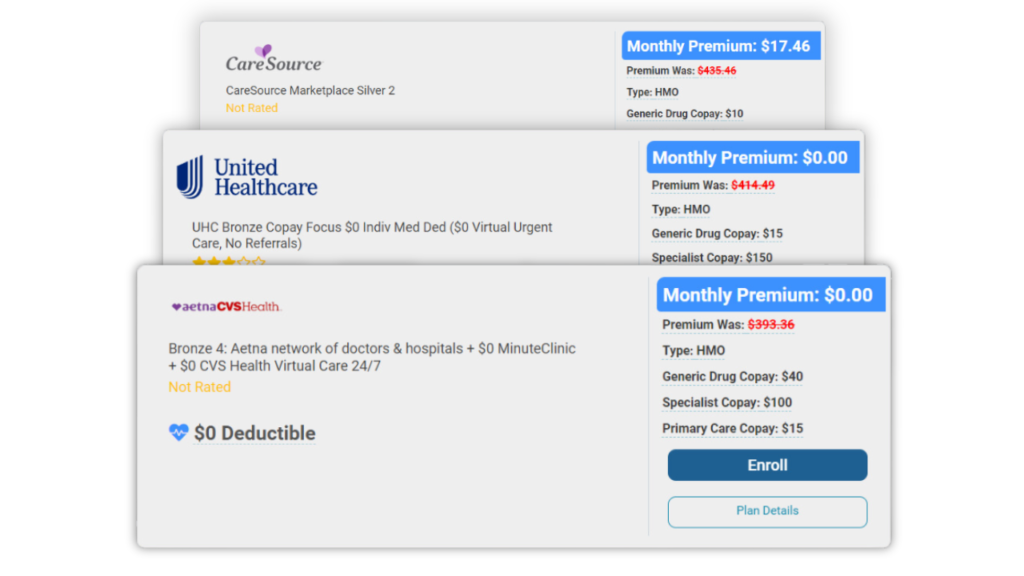

How Much Do Marketplace Plans Cost?

Medicaid Health Plans

State and federal Medicaid plans can be inexpensive options for health insurance while unemployed – based on your eligibility, you could even get a Medicaid plan free of cost. Generally, you’ll be eligible for Medicaid if you meet federal poverty level income requirements.

State-run Marketplace plans have their own Medicaid systems with different income requirements. This is based on the cost of living and other expenses.

When your eligibility is determined, your income levels will also be used to determine the monthly premium you pay for Medicaid coverage. This is a major reason why Medicaid is such an attractive option for health insurance while unemployed.

Just like Marketplace plans, you’ll have a special enrollment period for Medicaid for 60 days after losing health coverage from your job.

Medicare Health Insurance While Unemployed

Medicare is a collection of low-cost Federal health coverage plans. Seniors 65 and older are eligible for Medicare. If you’re eligible for Medicare, it’s an affordable option for health insurance while unemployed.

Medicare eligibility is open beyond those 65 and older; if you’re curious about Medicare, we can help answer your questions.

COBRA Continuation Coverage

The Consolidated Omnibus Budget Reconcilation Act (COBRA) is a federal law that allows workers to continue their group health coverage after losing a job. COBRA can be used to continue your health insurance coverage while you’re unemployed.

COBRA can provide familiarity; you can use it to continue your previous health plan, allowing you to potentially stay with familiar health care providers. However, if you choose COBRA continuation coverage, you’ll pay for your health insurance plan completely out of pocket – plus a 2% fee.

You won’t be eligible for the types of discounts that employers get on group coverage plans. The average monthly cost for health insurance premiums without the discounts employers get is $703 for single coverage or $1,997 for families.

Like the Marketplace and Medicaid, COBRA continuation coverage also offers a 60-day special enrollment period after loosing your previous employer’s health coverage.

COBRA coverage can be a good choice if you want to keep your previous coverage, but the cost is a major downside when looking for health insurance while unemployed.

Short-Term Health Insurance While Unemployed

Short-term health insurance is another option when you’re unemployed. These types of plans are a limited type of health insurance that usually last for a few months. However, short-term plans generally don’t need to comply with ACA guidelines and will often provide much less coverage than ACA plans.

Short-term health insurance can be less expensive than traditional health insurance plans. This can make short-term plans a tempting choice for health insurance while unemployed, but most of these plans have major downsides. Short-term policies often have high deductibles, copayments, and limited benefits.

Short-term health insurance can be an inexpensive option, but should generally only be used if you can’t qualify for an ACA-compliant plan on the Marketplace or Medicaid.

Joining A Spouse Or Parent’s Existing Coverage

If your spouse is enrolled in an employer-sponsored group plan that offers dependent coverage, that may be a good option. Similarly, you may want to join your parent’s health insurance plan if you’re younger than 26 years old. Depending on the insurance policy, dependents will likely raise rates for the policyholder.

Joining someone else’s plan can be another way to get health insurance while unemployed, but dependent coverage varies and can be limited or difficult to apply. If you’re unmarried or too old for coverage under a parent’s plan, you’ll have to look elsewhere.

Conclusion

You have many options for health insurance while unemployed and Marketplace plans can be some of the most cost-effective. COBRA continuation coverage can be helpful, but prices will likely be much higher than your previous employer-sponsored rates.

With so many options available, it can be difficult to find the right health insurance option when unemployed. Health Care Plan Quotes is here to help you find the health plan that best fits your needs. Call us at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m. ET; for health insurance cost estimates, check out our free online quoting tool.

Frequently Asked Questions

Even while unemployed, you have several options for health insurance. These include federal and state marketplace plans, Medicaid, COBRA continuation coverage, short-term health insurance, and joining an employed spouse’s group health plan.

Health insurance will typically expire at the end of the month when one loses their job.

While there is no “best” plan, great options for health insurance while unemployed include marketplace plans and state or federal Medicaid.

If you’re eligible for federal subsidies, the average cost for marketplace plans is $111 monthly.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data