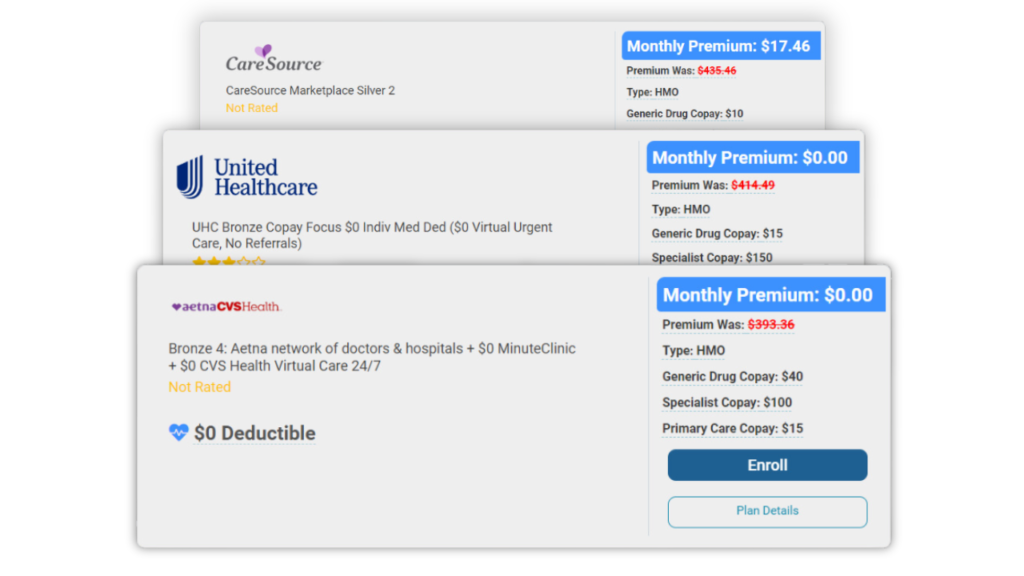

Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

How to Get the Best Prescription Insurance — Tier & Policy Explanations

Table of Contents

What is Prescription Insurance?

Prescription insurance is an insurance policy that helps pay the cost of certain prescription medications. Normally, when you sign up for a healthcare plan, it will include medication coverage. Policies will have a formulary, or list of covered drugs, that will tell you exactly how much you’ll pay for the medication.

Prescription Insurance Tiers Explained

ACA Marketplace Plans & Prescription Insurance

You’re in luck if you received a healthcare plan through the Federal Marketplace. All ACA Marketplace plans require prescription drug benefits since it is one of the essential health benefits that ACA covers. The coverage you receive depends on the plan, so work with an agent to ensure that your medication is covered under your policy.

Our agents are here to help you walk through all the coverage you need at the cheapest price. Call us at (855) 968-5736, and we will help you comprehend all the policy information.

Prescription Insurance Payments

Copays

Coinsurance

Deductibles

Stand-Alone Prescription Drug Coverage

Conclusion

Frequently Asked Questions

Yes, you can purchase stand-alone prescription insurance. However, unless you are eligible for Medicare, finding stand-alone prescription drug coverage might not be worth it since most healthcare plans include prescription insurance.

Prescription insurance works similarly to most healthcare coverage. When you receive a prescription, you can use your insurance at a pharmacy to pay a discounted price. Make sure your pharmacy will take your insurance before you go.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data