Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

Short-Term Health Insurance: When To Use It & What To Expect

Table of Contents

Short-term health insurance could be an attractive, inexpensive option when facing lapsing health coverage. But while short-term coverage can be cheaper than other forms of individual health insurance, it’s far from your only option.

Unlike Federal and State Marketplace plans, short-term insurers aren’t required to follow Affordable Care Act guidelines, so short-term health insurance can be limited in coverage. However, short-term health policies can be a helpful choice in some cases.

Health Care Plan Quotes is here to help you find the coverage you need at a price you like. Contact our expert agents at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m., ET, and they can help you review your healthcare options. Check our free online quoting tool for ACA-compliant plans on the Marketplace to compare with short-term health insurance.

What Is Short-Term Health Insurance?

Short-term health insurance, or Short-Term, Limited-Duration Insurance (STLDI), is a form of health insurance that only provides coverage for a short duration. In 2024, a Federal ruling set a four-month maximum coverage duration.

Short-term health insurance is typically less expensive than many other single coverage options, including those on the Marketplace. Premiums can start under $100 monthly for single coverage. But STLDI plans aren’t subject to any of the cost-lowering subsidies that reduce Marketplace plan premiums.

Short-term plans are exempt from ACA individual health insurance guidelines. Therefore, pre-existing conditions, chronic illnesses, and the ACA essential health benefits are unlikely to be covered on most policies.

What Does Short-Term Health Insurance Cover?

Short-term health insurance policies are generally inexpensive because they cover a focused list of health concerns. STLDI plans generally cover, but are not limited to:

- Emergency care

- Doctor visits

- Hospital stays

- Surgical procedures

Nearly every short-term policy will cover these healthcare procedures, leaving several of the essential health benefits uncovered. But for some, the savings that STLDI plans offer may be worth sacrificing coverage.

Short-term plans may cover some prescription drugs, but will usually only cover a limited selection of generic medications.

What Does Short-Term Health Insurance Not Cover?

STLDI policies usually don’t cover several of the ACA essential health benefits, including:

- Preventive care

- Mental health services

- Substance use treatment

- Maternity care

- Pre-existing conditions

- Chronic conditions

Benefits Of Short-Term Health Insurance

Short-term medical insurance does have a few benefits over more traditional plans. First of all, short-term policies can be cheaper than Marketplace plans without subsidies. Depending on your subsidy eligibility, a short-term plan can save you a lot of money on premiums.

You can apply for a short-term plan at any time. Unlike Marketplace and employer-sponsored plans, you are not subject to open enrollment period restrictions.

Most STLDI policies have limited underwriting, meaning most applicants are accepted regardless of preexisting conditions. And the enrollment process is usually very quick; once you’re accepted, you can likely expect coverage within a week.

Who Could Use Short-Term Health Insurance?

Short-term health insurance has specific benefits that can make it an appealing choice to a few groups. A primary use for short-term policies is for unemployed people, who can use it as temporary health insurance between jobs.

Similarly, unemployed graduates seeking employment who may not be eligible for Marketplace subsidies due to a lack of work experience can use STLDI policies.

Retirees waiting for Medicare eligibility can use a short-term plan as an interim health insurance policy.

STLDI plans can be a good choice for foreign travelers visiting the United States for an extended period.

Limitations Of Short-Term Health Insurance

While short-term health insurance has several benefits, it’s important to know its limitations. Unlike plans subject to ACA regulations, short-term medical insurance policies aren’t required to cover preexisting or chronic conditions.

And while the short coverage duration can be a boon when between jobs or waiting for a new policy, a four-month maximum may be too short.

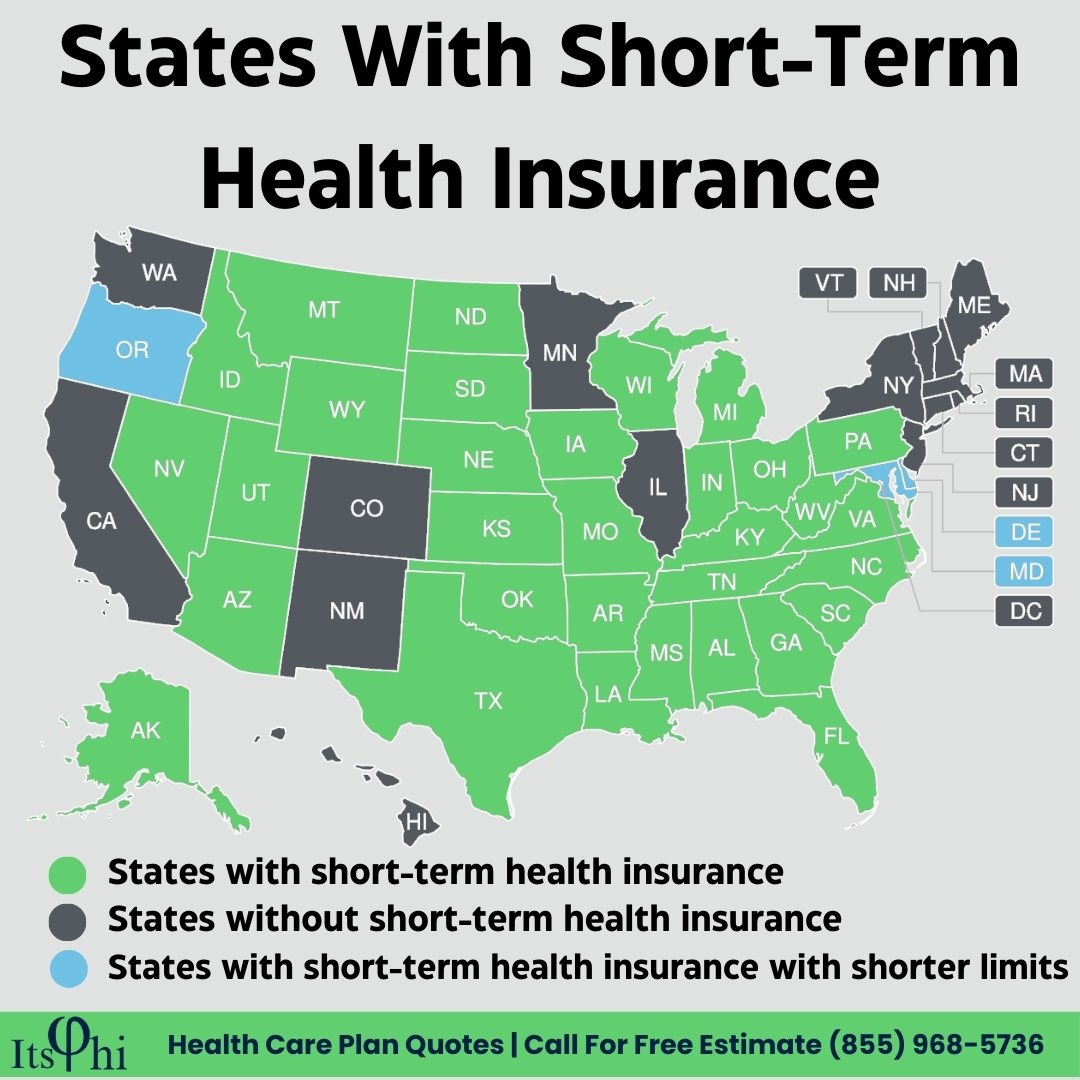

STLDI plans are not available in every state. 18 states and the District of Columbia have banned or constrained short-term health insurance.

Where Is Short-Term Health Insurance Available?

Short-term health insurance is unavailable in 15 states. In Delaware, Maryland, and Oregon, the maximum duration is three months.

If you live in any of these states, short-term medical insurance may be unappealing or inaccessible. Thankfully, quite a few other options are available.

If you’d like to review your options and compare costs, contact Health Care Plan Quotes. Our agents would be happy to help you examine your options and choose the coverage that best fits your needs.

Alternatives To Short-Term Health Insurance

Short-term plans have some benefits, but its limitations may leave you seeking alternatives. You’ll still have multiple options:

Federal & State Marketplace Plans

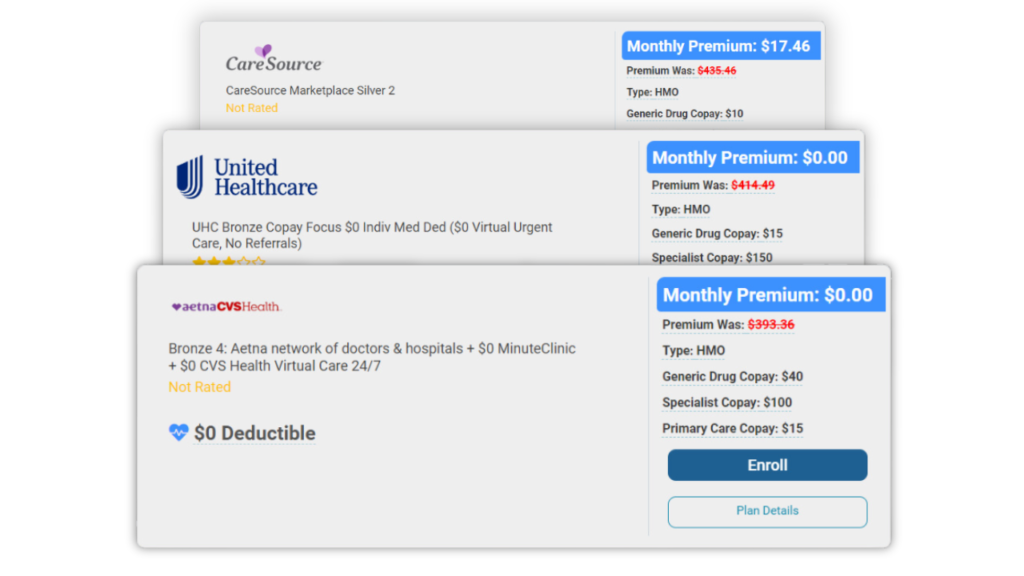

The main competitor to short-term medical insurance is the Marketplace. At face value, Marketplace plans may appear to be more expensive than STLDI policies. However, unlike short-term plans, Marketplace policies are subject to subsidies.

Four out of five Americans qualify for subsidies that can lower monthly premiums to as low as $0.

All Marketplace plans cover the ten essential health benefits defined by the ACA.

COBRA Continuation Coverage

COBRA continuation coverage is available to unemployed workers who previously were covered on an employer-sponsored group plan. Continuation coverage extends your previous coverage for 18 months.

With COBRA, you’ll need to pay your plan’s entire premium, even the portion covered by your former employer.

Medicaid & CHIP

For those who meet income requirements, Medicaid can be a more affordable option than Marketplace individual plans and short-term policies. Each state has its own Medicaid eligibility requirements, but generally, if your income is within 138% of the federal poverty level, you are likely eligible for a $0 monthly premium.

CHIP, the Children’s Health Insurance Program, has its own requirements. Even if your income is too high for Medicaid, your child may still qualify for CHIP coverage. CHIP covers medical and dental care for uninsured children to age 19.

Conclusion

Short-term health insurance can be an inexpensive option, but coverage can be limited. Some groups, like unemployed people, can effectively use short-term plans, but others could be better served by Marketplace plans or other options.

Health Care Plan Quotes is here to help you understand your healthcare options and ensure you find the right policy for your needs. Call us at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m., ET, and check our free online quoting tool for help with determining the healthcare choice that best fits your situation.

Frequently Asked Questions

Short-term policies best fit unemployed people, recent graduates looking for work, retirees waiting for Medicare eligibility, and foreign travelers to the United States.

A 2024 Federal mandate shortened short-term medical insurance coverage to a four-month maximum.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data