Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

How to Know If You Qualify For a Special Enrollment Period | Complex Issues & More

Table of Contents

Did you miss out on Open Enrollment health insurance coverage through Marketplace? Even though the Marketplace opens again in November, if you need insurance now, you might be eligible for a Special Enrollment Period (SEP) throughout the year. This allows you to apply for health coverage through Marketplace as long as the period is active.

But how do I know if I am eligible for an SEP? What happens if I get denied from a SEP even though I meet all the qualifying conditions? It’s a bit tricky to determine what exactly makes you qualify for, but we’ve broken it down for you in the simplest way possible. We’ll show you every qualification and hidden detail about SEPs.

Of course, you can always call one of our talented agents at (855) 968-5736 for the most accurate information on SEPs and your eligibility for them.

What is a Special Enrollment Period?

When is Open Enrollment for Marketplace Plans?

The Open Enrollment period is when new or existing applicants with a plan with Marketplace can enroll in, renew, or change their health plan through their portal. Enrollment dates start on November 1 and last until January 15.

Here are a few Open Enrollment dates that you should know:

- November 1: Open Enrollment starts.

- December 15: The last day to enroll in or change coverage for Marketplace plans starting January 1.

- January 1: Coverage begins for those who enrolled before December 15 and paid their first premium.

- January 15: Open Enrollment ends. After this date, you can enroll or change plans if you qualify for a Special Enrollment Period.

- February 1: Coverage begins for those who enrolled from December 16 to January 15 and paid their first premium.

What is a Qualifying Event for Insurance?

To qualify for a Special Enrollment Period, you’ll need to undergo a “significant life change” in the past 60 days or anticipate a life change in the next 60 days. Here are just a few of the qualifying events for insurance:

If You’ve Had a Change in Household

You can qualify for a Special Enrollment Period if you’ve experienced any of these changes in the household within the last 60 days:

- Marriage: you and your spouse can pick a Marketplace plan by the last day of the month, and your coverage will start at the beginning of the next month.

- Had a baby, adopted a child, or placed a child in foster care: coverage can start on the day that you apply as long as it’s within 60 days of the event.

- Death: if someone on your Marketplace plan dies and you lose your health plan, you are eligible for a SEP.

Typically, if you lost health insurance through a divorce or a legal separation, you are not eligible for SEPs unless there are other circumstances.

If You’ve Had a Change in Residence

Special Enrollment periods are available to those who either move to a new home in a different ZIP code or county or move to the US from a foreign territory.

You’ll also qualify for a SEP if you move to or from where you attend school, where you live and work as a seasonal employee, or a shelter.

Unfortunately, moving for medical treatment or vacation does not qualify you for SEPs.

If You’re Losing or Expected to Lose Coverage Within 60 Days

If you lose or expect to lose your health insurance coverage within 60 days, you’ll be eligible for a Special Enrollment Period.

There are plenty of reasons you might lose your coverage, and each comes with its stipulations. Here’s what you need to know about each loss of coverage option:

Lost Health Insurance Based on Job Coverage

If you lost your health coverage through your employer or family member, you will be eligible for a Special Enrollment Period. If you voluntarily drop your coverage, you are not eligible unless there was a decrease in your household income or if there was a change in your coverage that made you eligible for savings in your Marketplace plan.

If Your Individual Health Coverage Changes

If, within 60 days, you experience any of these events, you’ll be able to apply for a Special Enrollment Period:

- Your health coverage plan is discontinued

- You can no longer apply for a student health plan

- You moved outside of your plan’s service area

- Your plan ended in the middle of the year and chose not to renew it

- Your household income decreased

Lost Medicaid or CHIP Coverage

Lost Coverage From Medicare Part A

If you lost your premium-free Medicare Part A coverage, you are eligible for a Special Enrollment Period.

However, you won’t qualify for SEP if you lost Medicare by not paying for premiums or if you only had Medicare Part B or D.

Lose Coverage Through Family Member

If you lose coverage through a family member, you can apply for a Special Enrollment Period. Here are a few of the conditions that might make you eligible:

- Turning 26

- Family member loses health coverage or coverage for their dependents

- Divorce or legal separation

- Death of a family member

- You’re no longer a dependent

If an Employer Offers You an ICHRA or QSEHRA

If your employer offers you an individual coverage HRA (ICHRA) or a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA), you might qualify for a Special Enrollment Period.

You must apply for the qualification either 60 days before your plan changes or 60 days after.

Other Special Enrollment Period Qualifications

- Becoming a federally recognized member of a Native American tribe or an Alaska Native Claims Settlement Act Corporation shareholder

- Recently became a US citizen

- Leaving incarceration

- Starting or ending service as an AmeriCorps State and National, VISTA, or NCCC member.

Complex Special Enrollment Periods

Unexpected Situations — Medical or National Emergencies

If you were recently diagnosed with a serious medical condition, went through a national disaster, or experienced another national or state-level emergency that kept you from applying to a Marketplace plan, you can apply for a Special Enrollment Plan.

Applications due to a national disaster are only available if you live in a county that can apply for “individual assistance” or “public assistance” from the Federal Emergency Management Agency.

You’ll have 60 days from the accident or medical emergency date to complete your enrollment into an ACA Marketplace plan.

Enrollment Information Errors

Mistakes can happen, and if you were given the wrong information or there was inaction from the person you were working with, you can apply for a Special Enrollment Period. This extends to technical issues through the HealthCare.gov website or if there was an error when you were shown your health plan.

Domestic Abuse and Violence

Survivors of domestic abuse, domestic violence, or spousal abandonment can apply for a Special Enrollment Period. If your abuser or abandoner is on the same Marketplace plan, you’ll be able to enroll in a different plan alongside your dependents.

According to HealthCare.gov, if you’re still married to your abuser or abandoner, you can claim “unmarried” on your Marketplace application.

What Can I Do If I’m Denied a Special Enrollment Period?

How Do I Know If I’m Getting the Best Deal on Health Insurance?

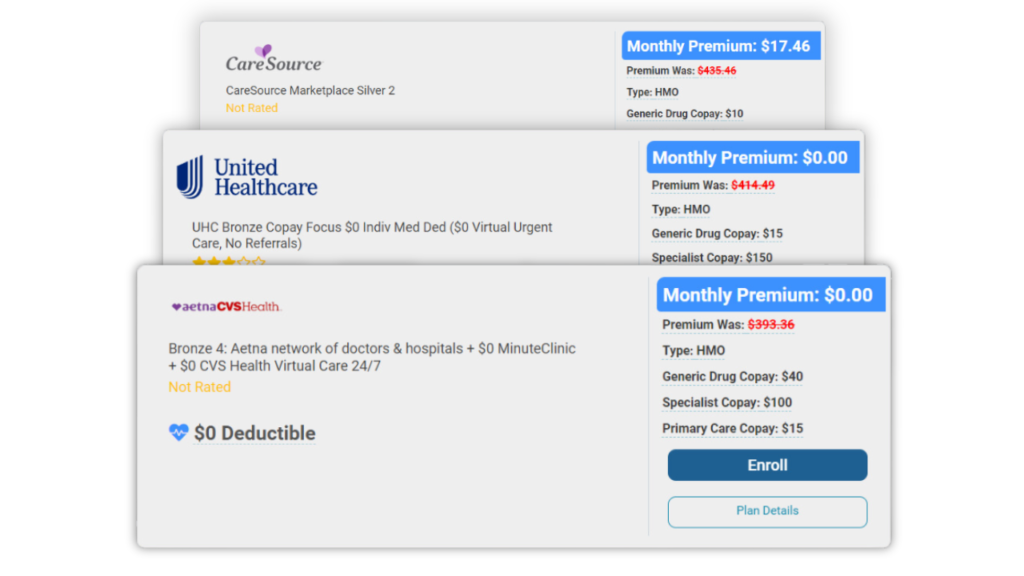

If you’re browsing through the Marketplace and are unsure of what health insurance is best for you, use our free quoting tool to help you decide. It’ll let you know approximately how much you will spend on great health insurance plans and the different benefits they offer.

You can also give us a call at (855) 968-5736 from 9 a.m. to 5 p.m. every weekday to talk to one of our agents about your health insurance coverage.

Conclusion

There are lots of factors that could make you eligible for a Special Enrollment Period. If you’re looking to enroll in a Marketplace plan but missed out on Open Enrollment, SEPs might be your only option until it opens up again in November.

The best way to find out if you are eligible for a SEP is to call us at (855) 968-5736, and we will provide you with the most accurate information.

Frequently Asked Questions

A Special Enrollment Period is a period outside of the Open Enrollment period where insurants can enroll in, adjust, or change their health plan through Marketplace.

Many different factors affect this enrollment period including a change in household, a change in residence, loss of coverage, turning 26, and more.

You can apply for a Special Enrollment Period by calling HealthCare.gov at 1-800-318-2596, applying to their screener, or by calling (855) 968-5736 for the most accurate information.

Typically, you’ll be able to apply for a Special Enrollment Period 60 days before or after a significant life change occurs.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data