Did you know 4 out of 5 Americans qualify for a $0 Health Plan?

Contact an Agent Today at (855) 968-5736

Supplemental Health Insurance | Every Price, Coverage Option & More

Table of Contents

What is Supplemental Health Insurance?

Supplemental health insurance is an additional health plan you can purchase to help support your healthcare plan. They can offset unexpected expenses when you’re in an accident or supplement your treatments when you’re diagnosed with cancer. If you’re concerned about medical costs or have a family history of disease, we highly recommend adding supplemental health insurance to your plan.

What can you use your supplemental health insurance payout on? Depending on the policy, you can use your coverage amount on deductibles, copays, and other expenses you could incur. That can include rent, groceries, and more.

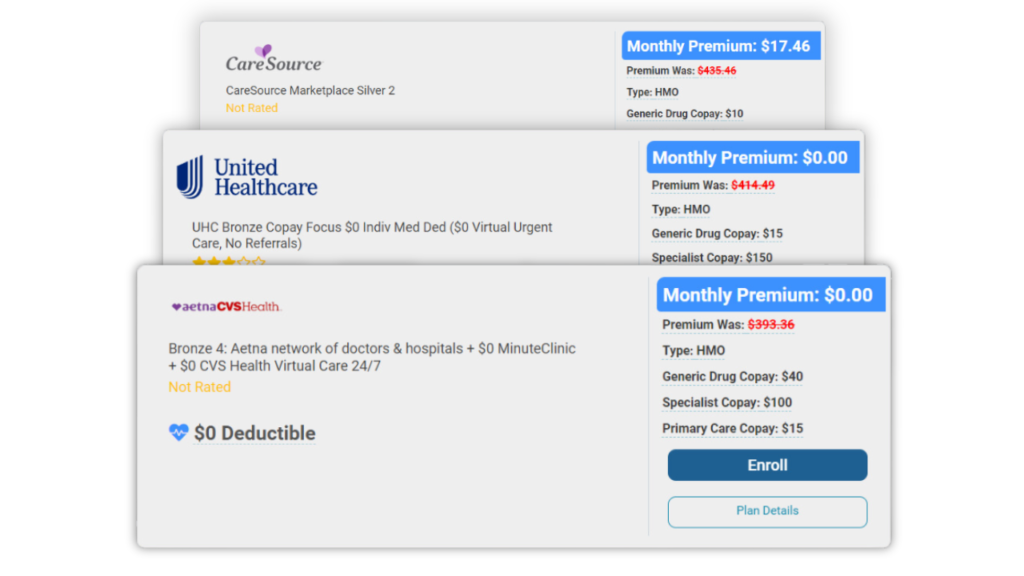

Unfortunately, supplemental health insurance doesn’t replace your health insurance plans, and you should look for traditional healthcare coverage. Health Care Plan Quotes is here to help you find your perfect insurance. Call us at (855) 968-5736, and we will help you navigate the Marketplace for your affordable insurance plan. Our agents are available every weekday from 9 a.m. to 5 p.m., and our unique quoting tool can give you an accurate price estimate on plans based on your tax subsidy.

Types of Supplemental Health Insurance

Accident Insurance

Cancer Insurance

Critical Illness Insurance

Critical illness insurance is supplemental insurance that provides coverage when diagnosed with several critical illnesses stated in your policy. That can include a sudden heart attack, stroke, coma, and more. These policies are typically a lump-sum payment, which means you’ll receive a one-time payment once you are diagnosed.

You can expect a $3 monthly premium for $5,000 worth of coverage. Premiums will depend on your age, gender, and the amount of coverage you want.

You should consider critical illness insurance if you have a family history of heart attack or stroke. Those who experience elevated health concerns such as obesity or tobacco usage should also consider grabbing critical illness insurance.

Dental Insurance

Disability Insurance

Long-Term Care Insurance

Travel Health Insurance

Unlike travel insurance, travel health insurance can help with emergency medical expenses while traveling or working abroad. You should pick up travel health insurance if you plan on working abroad or being a long-term resident overseas. Most plans cover you for around 180 days, so read your policy carefully for full details.

Vision Insurance

Like dental insurance, vision insurance is supplemental insurance that covers your optometrist visits, contact lenses, and prescription glasses. However, unlike dental insurance, general examinations require a copayment for exams, and you will receive an allowance that you can use on your contact lenses or glasses.

Depending on your policy, your allowance can reset yearly or every other year. The vision insurance premium can cost you $5 to $30 monthly. Premiums will depend on your provider, age, and location.

Medicare Supplemental Insurance (Medigap)

You might qualify for Medicare Supplemental Insurance (or Medigap) if you have Medicare. Medigap was created to cover out-of-pocket copayments, coinsurance, and deductibles that Original Medicare doesn’t cover.

Companies provide around 10 Medigap variations with increasing monthly premiums every year. However, discounts are available for women, non-smokers, and married couples.

Should I Get Supplemental Health Insurance?

You should get supplemental health insurance if you are concerned about various health concerns or must pay yearly expenses. The great thing about supplemental health insurance is that you can pick and choose the kind of coverage you want and opt out of insurance policies you don’t think you’ll need.

We highly recommend you pick up supplemental health insurance since it is generally inexpensive depending on the type of coverage.

Where Can I Get Supplemental Health Insurance

Conclusion

Frequently Asked Questions

Supplemental health insurance costs depend on the amount of coverage you want, the type of insurance, your age, and your location.

You should get supplemental health insurance if you have health concerns, a family history of illness, or plan on going to yearly checkups.

Supplemental health insurance can cover several things. Accidents, cancer, dental, and more. Each plan is unique, so determine your needs and speak to one of our agents so we can find your best coverage options.

Related Posts

How To Use Fixed Indemnity Insurance To Aid Your Health Coverage

Short-Term Health Insurance: When To Use It & What To Expect

The ACA Essential Health Benefits: Everything You Need To Know

A perfect health insurance plan created

just for you.

Enter your zip code to search Health Insurance Plans

Main Pages

Legal

Privacy Policy

Don’t Sell My Data